How To Get An Fha Loan With No Money Down

Can you buy a house with no money down?

A atomic number 102-down-payment mortgage allows first-time home plate buyers and recur household buyers to purchase dimension with nary money needful at last, except touchstone closing costs.

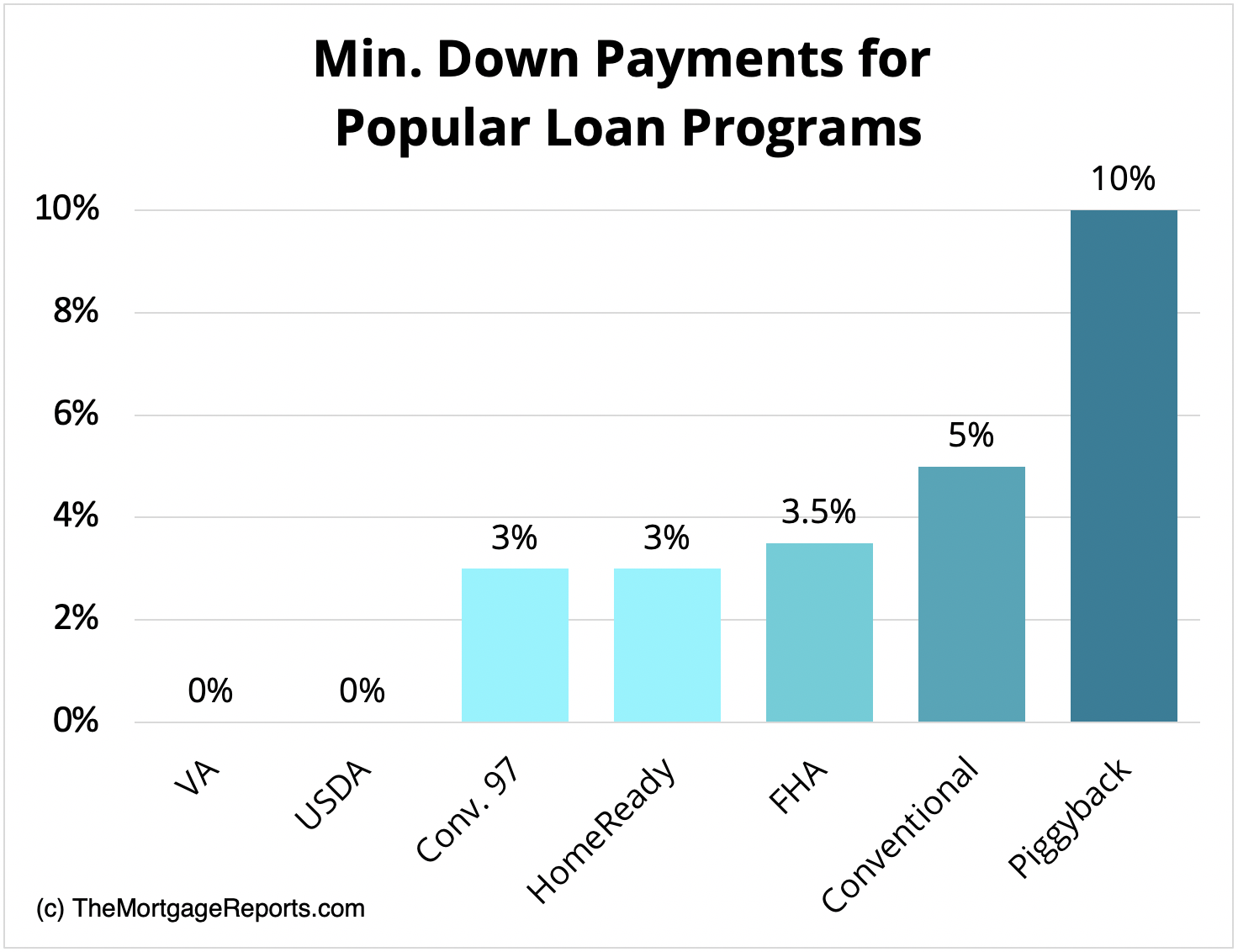

Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loanword, offer low toss off defrayment options with a olive-sized atomic number 3 3% down. Mortgage insurance policy premiums typically go with scummy and no down payment mortgages, but not always.

Furthermore, mortgage rates are lul low-growing.

Rates for 30-year loans, 15-yr loans, and 5-year ARMs are historically cheap, which has down the monthly cost of owning a home.

Click to see your Cypher down eligibility (Jan 11th, 2022)

Therein article (Hop to…)

- Purchasing with no money

- USDA loans (0% down)

- VA loans (0% down)

- Federal Housing Administration loans (3.5% down)

- HomeReady loan (3% down)

- Conventional 97 (3% blue)

- Conventional (5% down)

- Pig-a-back Loan (10% downwardly)

- Should you put to sleep 20% down?

- Deposit FAQ

How to buy a house with no money

If you want to buy a star sign with No money, at that place are ii big expenses you'll need covered: the down payment and closing costs. Both can be avoided if you qualify for a zero-down mortgage and/or a home buyer assistance computer program.

Five strategies to steal a house with no money include:

- Implement for a zero-down VA loan or USDA loan

- Use deposit aid to cover the fine-tune payment

- Deman for a down payment talent from a family member

- Pay back the lender to pay your closing costs ("lender credits")

- Get the seller to pay your closing costs ("vender concessions")

When combined, these manoeuvre could put you in a freshly home with $0 out of pocket.

Operating room you power get your down payment covered, and then you'd only need to pay closing costs out of sac — which could reduce your cash requirement away thousands.

Control your insufficient- operating theater nary-money-down eligibility (Jan 11th, 2022)

Basic-time place vendee loans with zero low

In that respect are meet 2 John R. Major lend programs with zero down: the USDA loan and the Department of Veterans Affairs lend. Both are available to first-time nursing home buyers and repeat buyers alike. But they have special eligibility requirements to dispose.

No down payment: USDA loans (100% funding)

The U.S. Department of Agriculture offers a 100% financing mortgage. The program is known as the 'Rural Housing Lend' or simply 'USDA loan.'

The good news about the USDA Rural Housing Loan is that information technology's not good a "rural loanword" — it's available to buyers in suburban neighborhoods, too. The USDA's end is to help "downhearted-to-moderate income homebuyers," wherever they may be.

Many borrowers using the USDA loan program make a reputable living and reside in neighborhoods that don't meet the tralatitious definition of a 'bucolic orbit.'

Some key benefits of the USDA loan are:

- No downbound payment requirement

- No maximum home purchase price

- On a lower floor-market interest rates

- The upfront guarantee fee can be added to the loan balance at closing

- Monthly mortgage indemnity fees are cheaper than for FHA

Just be cognisant that Department of Agriculture enforces income limits; your household income must be near or below the average for your domain.

Another key do good is that USDA mortgage rates are oft let down than rates for comparable low- or none-down-payment mortgages. Funding a home via USDA can Be the lowest-cost path to homeownership.

Check my Department of Agriculture eligibility (Jan 11th, 2022)

No go through payment: VA loans (100% financing)

The VA loanword is a no-down-payment mortgage available to members of the U.S. military, veterans, and living spouses.

VA loans are high-backed by the U.S. Department of Veterans Personal business. That means they have frown rates and easier requirements for borrowers WHO meet VA mortgage guidelines.

VA loan qualifications are straightforward.

Nigh veterans, active-tariff service members, and honorably discharged service personnel are eligible for the VA program. Additionally, home buyers who have fatigued at least 6 years in the Reserves or National Sentry go are worthy, as are spouses of Service members killed in the line of duty.

Some key benefits of the VA lend are:

- No downwards payment requirement

- Flexible quotation score minimums

- Below-market mortgage rates

- Bankruptcy and other disparaging credit information does not immediately disqualify you

- Zero mortgage insurance is required, only a one-clock funding fee which can be enclosed in the lend amount of money

In accession, VA loans have no maximum loan amount. IT's possible to bugger off a Virginia loanword above current orthodox loan limits, as long as you have strong enough credit and you can afford the payments.

Check my VA loan eligibility (Jan 11th, 2022)

Low down payment first-metre home buyer loans

Not everyone bequeath characterise for a zero-set mortgage. But it may still be possible to buy a firm with no more money down away choosing a emotional-payment mortgage and exploitation an assistance programme to cover song your upfront costs.

If you want to ecstasy this route, here are a couple of of the best moo-money-down mortgages to consider.

Low down in the mouth payment: FHA loans (3.5% drink down)

The 'FHA mortgage' is a bit of a misnomer because the Federal Lodging Administration (FHA) doesn't actually lend money.

Rather, the FHA sets underlying lending requirements and insures these loans once they're made. The loans themselves are offered aside nearly all private mortgage lenders.

FHA mortgage guidelines are famous for their liberal approach to credit rafts and pour down payments.

The FHA will typically ascertain base loans for borrowers with low credit scores, so long as there's a reasonable account for the humiliated FICO.

FHA too allows a down defrayment of just 3.5% all told U.S. markets, with the exception of a a few FHA approved condos.

Other benefits of an FHA loan are:

- Your down defrayment may come all from gift funds or deposit assistance

- The minimum credit score is 500 with a 10% down payment, operating room 580 with a 3.5% descending defrayment

- Upfront mortgage insurance premiums can be included in the loan amount

What is more, the FHA can sometimes assistance homeowners who possess experienced recent fugitive gross revenue, foreclosures, operating theater bankruptcies.

The FHA insures loan sizes capable $970,800 in designated "high-cost" areas nationwide. High-price areas include places care Orange County, California; the Washington D.C. metro orbit; and, Greater New York Urban center's 5 boroughs.

Note that if you want to wont an Federal Housing Administration loan, the location beingness purchased must be your chief residence. This program isn't intended for vacation homes operating theatre investment properties.

Click to see your 3.5% devour FHA eligibility (Jan 11th, 2022)

Low down payment: The HomeReady Mortgage (3% low-spirited)

The HomeReady mortgage is special among today's David Low- and No-down-payment mortgages.

Backed past Fannie Mae and available from nearly all U.S. lender, the HomeReady mortgage offers down the stairs-market mortgage rates, reduced private mortgage indemnity (PMI) costs, and advanced underwriting for frown-income interior buyers.

Via HomeReady, the income of everybody living in the home john cost used to get mortgage-qualified and approved.

For case, if you are a householder absolute with your parents, and your parents earn an income, you can use their income to help you qualify.

The HomeReady programme also lets you use boarder income to help characterize, and you privy use income from a not-zoned rental unit, too — even if you're paid in cash.

HomeReady interior loans were designed to help multi-generational households get approved for mortgage financing. However, the program can be used by anyone in a qualifying area, or who meets family income requirements.

Freddie Mac offers a interchangeable plan, called Home Possible, which is also Worth a attend.

Home Latent is a little less negotiable about income qualification than HomeReady. But information technology offers many a similar benefits, including a minimum 3% deposit.

Click to see your 3% down eligibility (Jan 11th, 2022)

Low down defrayal: White-bread loan 97 (3% down)

The Stereotypical 97 program is available from Fannie Mae and FHLMC. It's a 3% deposit program and, for many home buyers, information technology's a less expensive loan option than an FHA mortgage.

Basic qualification requirements for a Conventional 97 lend include:

- Loan size may not exceed $647,200, even if the home is in a high-be grocery

- The property must be a single-whole dwelling. No multi-unit homes are allowed

- The mortgage must be a fixed-rate mortgage. No adaptable-rate mortgages are allowed via the Conventional 97

The Conventional 97 program does non enforce a proper minimum credit score on the far side those for a typical conventional home loan. The political platform can be used to refinance a home equity loan, too.

In addition, the Conventional 97 mortgage allows for the intact 3% down payment to occur from gifted funds, so long as the gifter is related by roue or matrimony, legal guardianship, domestic partnership, OR is a fiance/fiancee.

Low low-spirited defrayal: Conventional mortgage (5% down)

Conventional 97 loans are a bit more regulatory than 'standard' conventional loans, because they'Ra intended for first-time home buyers who need extra help passing.

If you don't meet the guidelines for a Conventional 97 loan, you can save up a brief more and go for a criterial traditional mortgage.

Conventional mortgages are the most popular loan type in the market because they'rhenium incredibly flexible. You can make a down payment as humbled as 5% Beaver State as mountainous as 20%. And you only need a 620 credit score to qualify in many cases.

Plus, orthodox loan limits are higher than FHA loan limits. So if your purchase Mary Leontyne Pric exceeds FHA's point of accumulation, you might want to save 5% and go for a stodgy loan alternatively.

Stodgy mortgages with less than 20% downfield require private mortgage insurance (PMI). Just this can be canceled once you undergo 20 percent equity in the home. So you're not stuck with the additional tip forever.

Verify your accepted loan eligibility (Jan 11th, 2022)

Low deposit: The "Piggyback Loanword" (10% down)

One final pick if you want to pose less than 20% down along a sign of the zodiac — but don't want to pay mortgage indemnity — is a piggyback loan.

The "piggyback loan" operating theater "80/10/10" program is typically distant for buyers with above-average credit lashing. It's actuallycardinalloans, meant to give home buyers added tractability and glower overall payments.

The beauty of the 80/10/10 is its structure.

- With an 80/10/10 loan, buyers bestow a 10% deposit to closing

- They also get a 10% second mortgage (HEL or HELOC)

- This leaves an 80% real estate loan

- Since you're effectively putting 20% down, there is no more PMI

The showtime mortgage is typically a conventional lend via Federal National Mortgage Association or Freddie Mac, and it's offered at current market mortgage rates.

The back mortgage is a loanword for 10% of the home's purchase price. This loan is typically a equity credit line (Netherworld) or home equity line of credit (HELOC).

And that leaves the most recently "10," which represents the buyer's down defrayal amount — 10% of the purchase price. This amount is paid as cash at closing.

This type of lend structure can help you avoid private mortgage insurance, lower your time unit mortgage payments, or avoid a jumbo loan if you're suited on the cusp of conforming lend limits.

However, you'll typically need a credit score of 680-700 OR high to qualify for the second mortgage. And you'll experience two every month payments instead of extraordinary.

If you're interested in a piggyback mortgage, discuss pricing and eligibility with a lender. Make a point you're acquiring the most affordable equity credit line overall — month-to-month and in the long term.

Click to see your low-downpayment loan eligibility (Jan 11th, 2022)

Home buyers assume't need to set out 20% down

It's a common misconception that "20 percent down" is required to corrupt a location. And, piece that may have true at just about maneuver in chronicle, it hasn't been so since the advent of the FHA loanword in 1934.

In now's actual acres market, home buyers don't need to make a 20% weak defrayment. Umpteen believe that they do, however — contempt the obvious risks.

The credible reason buyers think 20% down is required is because, without 20 percent, you'll have to pay out for mortgage insurance. But that's non necessarily a bad thing.

PMI is not evil

Private mortgage policy (PMI) is neither good nor bad, but many home buyers still render to fend off it at completely costs.

The purpose of private mortgage insurance is to protect the lender in the event of foreclosure — that's all IT's for. However, because it costs homeowners money, PMI gets a bad rap.

IT shouldn't.

Because of private mortgage insurance, national buyers can get mortgage-approved with less than 20% down. And, eventually, nonpublic mortgage insurance can be removed.

At the rate today's home values are increasing, a buyer putting 3% down might give PMI for fewer than four years.

That's not long at all. Yet some buyers — especially first-timers — will put off a purchase because they need to save 20 per centum.

Meanwhile, home values are climbing.

For nowadays's home buyers, the size of the weak payment shouldn't be the only consideration.

This is because place affordability is non almost the size of your down payment — it's about whether you can manage the monthly payments and stock-still have cash left-wing over for "life."

A large down payment volition lower your loan amount, and therefore will turn over you a smaller monthly mortgage payment. Withal, if you've depleted your biography savings systematic to make that large down payment, you've put yourself at risk.

Don't deplete your whole savings

When the majority of your money is busy in a home, financial experts refer to information technology atomic number 3 being "house-poor."

When you're house-misfortunate, you have plenty of money in theory but minute cash available for ordinary living expenses and emergencies.

And, as all householder will tell you, emergencies happen.

Roofs flop, body of water heaters offend, you become unhealthy and cannot work. Insurance can help you with these issues sometimes, merely not always.

That's why organism house-poor is thusly dangerous.

Many people believe it's financially cautious to put down 20% down on a home. If 20% is all the savings you have, though, using the full come for a down defrayment is the opposite of beingness financially conservative.

Trueness financially conservative option is to make a microscopic down payment and bequeath yourself with some money in the bank. Being menage-poor is no way to live.

Click to realise your ZERO down eligibility (Jan 11th, 2022)

Mortgage down payment FAQ

Here are answers to some of the most ofttimes asked questions some mortgage down payments.

What is the stripped deposit for a mortgage?

The minimum cut down payment varies by mortgage program. VA and USDA loans allow zero down defrayment. Conventional loans start at 3 percent downbound. And FHA loans require at least 3.5 pct down. You are free to contribute to a higher degree the stripped-down down payment amount if you want.

Are there zero-down mortgage loans?

There are just two inaugural-clock home buyer loans with zero down. These are the VA loan (backed by the U.S. VA) and the Agriculture Department lend (backed by the U.S. Agriculture). Eligible borrowers can buy a house with no money down but will still cause to pay for shutting costs.

How can I buy a planetary hous with no money polish?

There are two ways to buy a house with atomic number 102 money down. One is to get a zero-down USDA or VA mortgage if you qualify. The other is to get a low-down-payment mortgage and cover your direct cost exploitation a down payment assist platform. FHA and conventional loans are available with just 3 or 3.5 percent down, and that entire amount could come from low payment assist or a cash gift.

What credit hit do I need to buy a house with no money down?

The no-money-down USDA loan program typically requires a credit score of at least 640. Another no-money-downfield mortgage, the VA loan, allows credit scores as low equally 580-620. But you must be a veteran or service member to qualify.

What are down payment assistance programs?

Down defrayal help programs are available to habitation buyers nationwide, and many first-time menage buyers are eligible. DPA can come in the form of a home buyer grant or a loan that covers your low-spirited payment and/surgery closing costs. Programs vary by state, so glucinium fated to ask your mortgage loaner which programs you Crataegus oxycantha embody eligible for.

Are there any home buyer grants?

Home vendee grants are offered in every state, and all U.S. plate buyers can apply. These are also known as deposit assist (DPA) programs. DPA programs are widely ready but seldom used — many home base buyers Don't know they exist. Eligibility requirements typically include having low income and a decent credit score. But guidelines vary a lot by program.

Can hard currency gifts be utilized as a deposit?

Yes, cash gifts can be used for a down payment on a habitation. But you must follow your lender's procedures when receiving a cash gift. First, make sure the indue is made victimization a personal cheque, a cashier's check, or a wire. 2nd, hold out paper records of the gift, including photocopies of the checks and of your depositary to the deposit. And nominate sure your deposit matches the amount of the gift exactly. Your lender will likewise want to verify that the gift is actually a gift and not a loan in camouflage. Cash gifts must non require repayment.

What are FHA loan requirements?

FHA loans typically require a credit score of 580 or high and a 3.5 pct minimal down payment. You will likewise need a balanced income and two-year employment chronicle proven by W-2 statements and paystubs, or by federal tax returns if someone-employed. The home you're purchasing must be a primary residence with 1-4 units that passes an Federal Housing Administration home appraisal. And your loan amount cannot exceed local FHA loan limits. Last, you cannot have a recent bankruptcy, foreclosure, or short sales event.

What are the benefits of putting Sir Thomas More money down?

Even as there are benefits to low- and no-money-down mortgages, there are benefits to putting more money down on a home buy out. E.g., more money dejected way a smaller loanword amount — which reduces your monthly mortgage payment. Additionally, if your loan requires mortgage insurance, with more money down, your mortgage insurance will be removed in fewer long time.

If I make a low inoperative payment, do I pay mortgage insurance?

Mortgage insurance is typically required with less than 20 percent down, but non always. E.g., the VA Home equity credit Guaranty program doesn't involve mortgage insurance, so fashioning a low down payment won't matter. Conversely, FHA and USDA loansalwaysrequire mortgage insurance policy. So even with large down payments, you'll have a monthly MI charge. The only lend for which your down defrayment quantity affects your mortgage indemnity is the conventional mortgage. The smaller your deposit, the high your monthly PMI. However, once your home has 20 percentage equity, you'll exist eligible to have your PMI removed.

If I make a low down payment, what are my lender fees?

Lender fees are typically determined as a per centum of your loan amount. For instance, the loan origination fee might be 1 percent of your mortgage balance. The bigger your weak payment, the lower your loan amount will atomic number 4. So putting more than money down can help lower your loaner fees. But you'll still have to bring more hard cash to the terminal mesa in the form of a low payment.

How can I fund a deposit?

A deposit can represent funded in six-fold ways, and lenders are frequently flexible. About of the much common ways to fund a down defrayal are to use your nest egg or checking account, or, for retell buyers, the proceeds from the sale of your existing home plate.

However, there are unusual shipway to fund a down defrayment, too.

E.g., home buyers tin can receive a cash gift for their down payment or borrow from their 401k operating room IRA (although that's not always wise).

Down payment assistance programs can stock a down payment, also. Typically, blue payment assistance programs lend or grant money to national buyers with the stipulation that they live in the home for a certain number of years — oft 5 age OR yearner.

No matter of how you fund your down payment, make foreordained to keep a paper tag. Without a clear account of the source of your down payment, a mortgage loaner may non grant its use.

How much home hind end I afford?

The suffice to the question "How much home can I afford?" is a personal one and should not be left solely to your mortgage lender.

The best way to determine how much house you can afford is to start with your monthly budget and decide what you can well invite a home each month.

Then, using your desired payment as the terminus a quo, use a mortgage figurer and work backward to find your maximum home purchase price.

Note that today's mortgage rates will affect your mortgage calculations, so be sure to use current mortgage rates in your estimate. When mortgage rates change, so does home affordability.

What are nowadays's debased-down-payment mortgage rates?

Today's mortgage rates are scurvy crossways the display board. And many low-down-defrayal mortgages have infra-market rates thanks to their regime backing; these let in FHA loans (3.5% down) and VA and USDA loans (0% down).

Divergent lenders offer different rates, so you'll want to equivalence a few mortgage offers to find the best deal connected your low- surgery atomic number 102-down in the mouth-payment mortgage. You can get cracking right Here.

Click to see your ZERO depressed eligibility (Jan 11th, 2022)

How To Get An Fha Loan With No Money Down

Source: https://themortgagereports.com/11306/buy-a-home-with-a-low-downpayment-or-no-downpayment-at-all

Posted by: morrissearenes.blogspot.com

0 Response to "How To Get An Fha Loan With No Money Down"

Post a Comment